The complete guide to financial services outsourcing

To do expense form template this, you could create a guidelines document or conduct an onboarding session with your outsourced team to ensure that everyone is on the same page. This allows you to benefit from top-of-the-line tools at a fraction of the cost you’d incur if you invested in them yourself. Outsourcing services usually have the latest software for performing the finance function, allowing you to benefit from their constantly updated infrastructure.

What is financial services outsourcing?

When you decide that outsourcing is the right choice for your company, it’s time to find the provider that meets your small business tax preparation checklist for 2021 your finance and accounting needs. Many finance and accounting firms used to offer an all-or-nothing approach to accounting, but things have changed. With increased customer-centricity in business and understanding that every business has unique needs, we have seen a major shift towards customization.

Fractional CFO Services

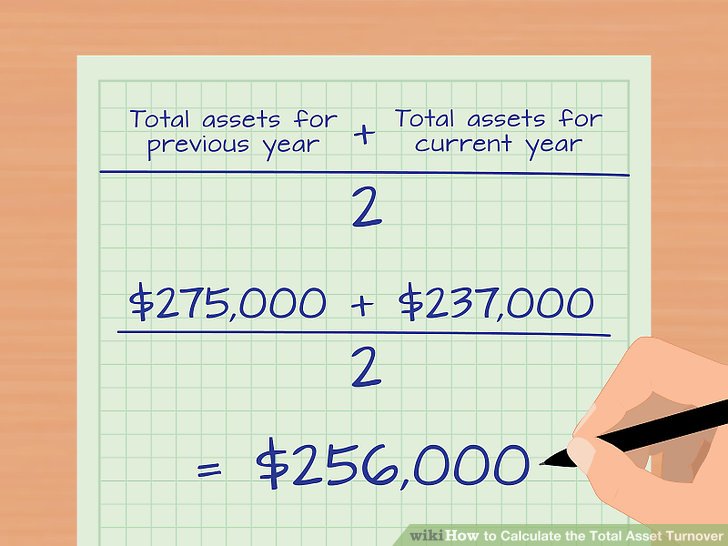

The person appraising the value of your business will want to take a historical look at your income trends that may or may not devalue your business. They will want to examine your financial records to identify potential for future growth, which will increase valuation. Therefore, outdated and inefficient transactional processing and a lack of formal documentation policies or financial controls can hurt your business and impact the valuation of your company. If at some point, you need to seek funding or intend to sell your business, you need accounting valuation to value your company’s assets and liabilities. From cash flow to future performance and financial leverage, many factors determine the value of a company. In addition, RSM has a dedicated technology team that supports FAO resources to increase education, and we deploy emerging innovations to improve our outsourcing platform.

- With accurate finance and accounting records, you can decide how to reinvest in your company, evaluating cash on hand and anticipated costs that may impact cash flow.

- Additionally, take into consideration language barriers that may exist between your in-house team and the outsourced one.

- This is where payroll processing services come into play, offering a streamlined and efficient approach to managing your team’s compensation.

- To discuss outsourcing your finance and accounting outsourcing and our customizable solutions, request a demo today.

- Time Doctor is an all-in-one productivity management and time tracking system that helps you optimize your outsourced and in-house teams’ productivity.

- They’re a strategic tool that can significantly enhance your business efficiency and growth.

Chief financial officer (CFO)

They can also help identify tax-saving opportunities that you may have overlooked, translating into more money in your pocket. Therefore, outsourcing cuts much of the cost that comes with having an in-house team but still what is the revenue recognition principle allows you to work with the best professionals in the F&A industry. Popular project management tools you could choose from include software like Trello and Asana. While it may not be possible to accurately calculate your outsourcing expenditure yet, you need a rough estimate to ensure your business doesn’t risk overspending. For example, if you’re in the United States and your outsourced team is in India, they would naturally have different work hours from yours. This is especially beneficial if your managers are responsible for other departments and aren’t particularly experienced in financial management.

Advanced Technologies and Systems – Small-to-medium enterprises may not always be updated on the latest finance and accounting applications. To meet their needs, RSM provides outsourcing solutions that cost-effectively improve finance and accounting functions. We offer a suite of services that leverage leading technology platforms tailored to your own unique needs. You won’t have to spend time and money finding and hiring the right employees – just hire an outsourced team and get started immediately.

Outsourcing is an excellent way to reduce costs and increase efficiencies but it is essential to partner with a provider that is right for your business and that starts by ticking a few key boxes. While instant messaging is great for quick questions or real-time responses, it isn’t a perfect substitute for a face-to-face conversation with your outsourced team members. After all, text messages aren’t also ideal when it comes to detailed discussions or lengthy explanations. For the final step, work on a short project or task with each of the outsourcing providers you’ve selected.

By outsourcing your financial services, you can increase the efficiency of your in-house staff as well. Outsourcing your finance tasks allows you to work with the best professionals in the financial services sector from across the world. These teams are experienced at working remotely to provide as much, if not more, value when compared to an in-house team.

After analyzing the trial project, you should have a clear picture of the best outsourcing provider for your financial services. It’s undeniable that outsourcing finance talent can provide numerous benefits, including cost savings and access to highly skilled professionals. In addition, your finance outsourcing costs will be lower than the salaries you would have to pay by hiring from your local area. This is especially true if you hire talent from regions with lower wages and living costs, such as Latin America (LatAm). You can engage the remote services of senior finance talent based outside the US for a lower monthly cost than their US-based peers. As you navigate the complexities of your startup’s financial landscape, remember that finance and accounting outsourcing is more than just a convenience.

Therefore, the ideal finance and accounting provider should have developed methods and established metrics and KPIs that measure success and identify errors. Cloud-Based Software Solutions – To benefit the most from artificial intelligence, you need a solution provider that can help you centralize your system, standardize it, and automate it. With all your financial data stored in the same place, you increase efficiency, share data effectively, and lower the risk of accounting errors significantly. When you outsource a team that leverages cloud solutions, you not only benefit from streamlined accounting processes but lower IT costs as it relieves you of the high costs of infrastructure and maintenance.