Martingale Approach inside the The forex market: The dangers and you may Advantages

Articles

In this article, we will talk about the requirement for risk administration while using the Martingale strategy in the trading and gives strategies for managing the risk effortlessly. The last action in order to exchange to your Martingale method is to romantic the new trading in the event the areas begin moving in their favour once more. In conclusion, the new Martingale means will be a useful equipment in more secure certain business criteria, nevertheless would be to use it carefully.

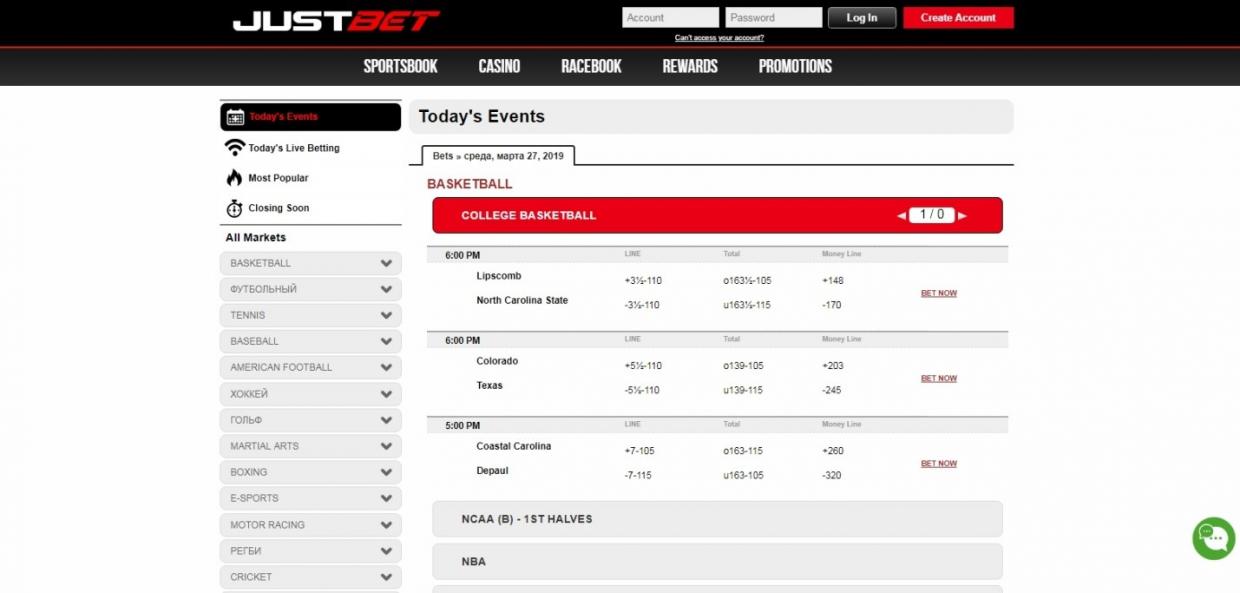

How to pick a Forex Agent?

The fresh Fx-eTrader program can establish the fresh EA document according to your setup. It does normally be in the form of a good .ex4 or .ex5 document, with respect to the type of Metatrader you might be using. Arrange entryway indicators playing with technology signs and other standards. Explain the fresh problems that should be came across on the robot in order to begin a trade. Admission laws and regulations may include signs such Swinging Averages, Cousin Power Index (RSI), otherwise personalized symptoms. So you can effectively use the brand new Martingale Strategy, it is important to find popular cryptocurrencies with an excellent exchangeability and upward trending rates having high good and the bad.

- Traders increase their condition types after successful deals, taking advantage of confident impetus.

- That’s as to why if you even be interested in with the martingale strategy regarding the stock-exchange, it ought to very first be changed a bit.

- This method turns out a stylish idea if the the money pair is unstable adequate since the, for analogy, moves of 20 pips within the one another guidelines try much more preferred than just movements 40 pips.

- In the 4th change, it risked just one% of your harmony however, been successful.

- Such as, you ought to rally a few plenty of Euros (EUR)/All of us cash (USD) in one.181 to at least one.182 to ensure that you do not flunk of your own very first change.

How does the fresh Martingale means operate in the forex market?

- The concept are in the first place created for betting, and is in line with the analytical results of a conference that have a good 50% probability of they taking place, such successful a trade.

- In conclusion, the newest Martingale Strategy elicits mixed views out of specialists in the newest gaming and you can betting globe.

- Taking an obtainable and you may innovative trading feel ‘s the aim of Quotex.

- By having certain entry and you can hop out issues, buyers can raise its likelihood of success and steer clear of getting stuck inside undesirable field standards.

- Buyers that are okay with getting large risks you will such as this strategy as it provides the possible opportunity to recover loss quickly.

- The newest Martingale technique is an investing method which involves increasing the sum of money which is dedicated to a swap when the prior trade are missing.

However, counting entirely about this approach might be high-risk, since it needs a substantial bankroll and you can doesn’t make sure eventual achievement. The new FXTradepro method, which involves a series which have a total of twenty four entries and you can progressively broadening parcel versions, portrays just how traders can also be create prospective losses if you are targeting profitability. By adding such factors into your trading bundle, you could navigate the reasons of the Martingale approach having deeper trust and you will control. Other big disadvantage is the habit of leading to a burning condition, which can reinforce negative change habits.

It assumes you to definitely a losing trade will ultimately end up being followed mrbetlogin.com read review closely by a winning trade, and also by increasing the newest investment after each loss, the brand new eventual winnings will cover all the prior loss, causing a net funds. When trade cryptocurrency, the initial code is always to do your homework. It’s extremely important when setting out that you know the sort of the new crypto market and, after that, the best trading procedures that will help you make money. While the martingale approach contains the potential to ensure you get because of an investment reputation with no losings, the strategy has intrinsic threats. Listed below are some of the benefits and drawbacks of your own martingale means that you should understand. As these is opposite methods, the idea says a trader should select one that fits their requirements.

When a gambler who spends this technique knowledge a loss of profits, they immediately double the measurements of another choice. By the several times doubling the new bet once they lose, the newest gambler, in theory, at some point even out with an earn. The easiest way to decrease the possibility of the brand new martingale method is to make use of a halt-losings buy. A halt-losings purchase is an order to close off a trade during the an excellent preset rates if the industry moves against the trader.

The fresh Martingale method as well as requires way too much financing to to function, since the investors should be able to security its loss and you can remain increasing their status proportions. This leads to a situation in which an investor’s whole exchange membership is actually annihilated in one trade. Very few buyers properly have fun with martingales over long intervals.

To deal with so it, We turned to the new FSB Pro Approach Creator, a hack I was making use of for more than 5 years in order to instantly create pro advisers. If you would like produce an expert trading, you must understand that it is needed to consider the loss and you may imagine they in this a normal situation, instead in any case supposed to get rid of all money. Sure, as a result, the fresh intent would be to keep increasing the newest wager until a winnings is made. In the event of a hit, the brand new bettor can also be recover everything you starred and sound right the newest win of the very first wager. Should this be maybe not the challenge as there are no victory, the gamer, with run out of potato chips, could only withdraw having blank pockets. Nevertheless, the principle at the rear of the brand new martingale method continues to be the exact same.

Trick Takeaways In the Help guide to Martingale This market Strategy

Starting an account is free and availableness a great $100,000 demonstration account to evaluate the machine. Such networks provide powerful devices to own technology analysis, automated trading via Specialist Advisors (EAs), as well as the capability to backtest steps to your historic study. Definitely occasionally a money is going to be devalued, but occasionally if you have a strong miss, the value of the fresh money does not reach no.

The newest Martingale Means inside the fx is actually a threat management approach one relates to expanding trading ranks once losings, centered on the fact a winning trading at some point exist. Whenever applying the brand new martingale means, it is important to display screen your own bet proportions and avoid letting they spiral unmanageable. Loss can easily collect and get unmanageable, causing a lot more currency are missing than simply anticipated.

So it change approach may potentially leave you a hundred% profitable, seems like a dream proper? Really, there is an amount to pay for Martingale therefore before you could ensure you get your hopes right up, I’ll tell you that the cost is big. A trader can make an initial acquisition of $ten,100 well worth shares when a buddies are trade from the $a hundred. Following the fresh inventory rates drops and they create another buy to have double the inside the well worth ($20,000) while it’s now available (trading in the 50). The dimensions of the brand new winning trading often surpass the fresh combined losses for the all of the previous investments. Cautiously determine condition versions based on your bank account proportions and you can chance threshold.

Even if organizations can certainly wade bankrupt, most places merely take action from the possibilities. But not, inside cases of a-sharp decline, the fresh money’s really worth hardly has reached zero. While in the this step, and if money away from 2% try reached, regardless of whether all finance were put, the brand new robot have a tendency to execute a rob money action and initiate an excellent the fresh round of shopping for and attempting to sell. «IQ Choice is an excellent agent to begin with with a slick platform and you may low minimal money. New users can also discover a merchant account inside three points.»

If your inventory price drops regarding the following the day as well as the investor purchases $dos,100000 worth of the fresh inventory from the $twenty five, the common to shop for rates drops to help you $29 for each and every show. The individual does not have enough currency so you can twice down, so they wager all of it. The new anti-martingale strategy is the contrary of the martingale we features informed me above. Unlike including how big positions, it involves halving the newest wager each time once you make an excellent losings.